As the economy improves and the Federal Reserve (“Fed”) ends its quantitative easing program in October the next question for investors is when will the Fed raise rates?

Which Factors Are Most Important to Raise Interest Rates?

The Fed will look at many factors when deciding whether to raise rates including economic growth, the unemployment rate, wage growth and inflation. As a reminder, the Fed has a dual mandate of stable prices and low unemployment.

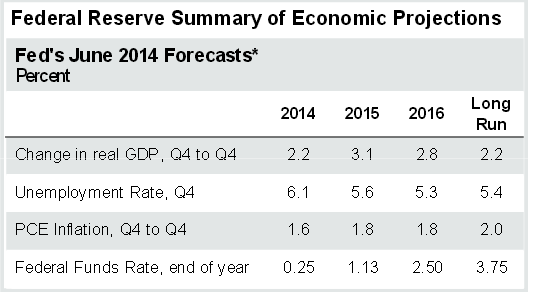

The primary concern for the Fed today is unemployment as noted in a quote by Janet Yellen, the Federal Reserve Board chairwoman, “one reason why I believe it is appropriate for the Federal Reserve to continue to provide substantial help to the labor market, without adding to the risks of inflation, is because of the evidence I see that there remains considerable slack in the economy and the labor market”. As noted in the chart below the Fed expects to see improvements in GDP and unemployment rate, but inflation is forecasted to remain low.

* Forecasts of 16 FOMC participants, midpoints of central tendency except for federal funds rate which is the median estimate.

Source: JP Morgan – Guide the Markets, June 30, 2014.

Does this mean the Fed will raise short-term rates this year?

It’s highly unlikely as it is expected the Fed will use caution on deciding when to raise interest rates as it doesn’t want to be too early and force a recession. A lot of “experts” are expecting the first rate increase in the middle of 2015, but it’s anyone’s guess at this point. It was once said the role of the Federal Reserve was, “to take away the punch bowl just as the party gets going”, or raise interest rates when the economy reaches peak activity. Given the lasting effects of the great recession it is expected the Fed will keep the punch bowl out a little longer than normal.

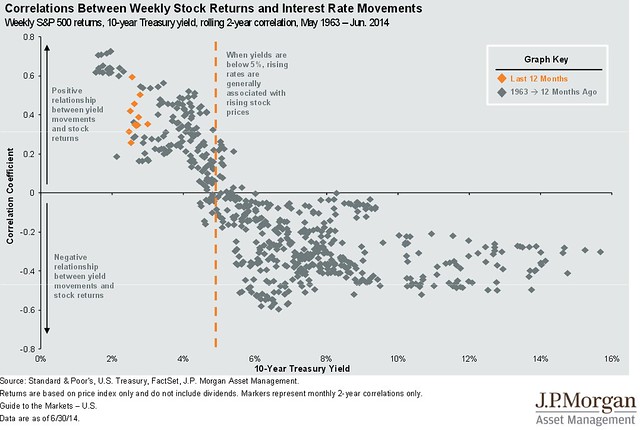

What does this mean to the equity markets when the Fed does raise rates? First, the stock market is forward looking, so some degree of rate increases have already been factored into the market. Second, as noted in the chart below, historically, until 10-year treasury yield exceed 5% rising interest rates have no negative impact to the stock market. In fact, the impact at the current interest rates are positive.

Source: JP Morgan – Guide the Markets, June 30, 2014.

How quickly will the Fed raise rates?

It is expected at a measured pace as the economy has not fully recovered from the great recession. Historically, the Fed funds rate has averaged about 2% more than inflation (2% real), but given the amount of debt in the private and public sector they will likely keep the Fed rate at inflation (0% real). This low rate helps private and public borrowers pay of their debt quicker. This will likely mean lower rates for the foreseeable future as we predicted in our blog post last year, When Will Interest Rates Rise? as 10-year Treasury yields took 25 years from their low in 1941 (~2.0%) to exceed 5% in 1966.

What should you do today given this news?

Nothing. Continue to follow your investment strategy and financial plan. Or if you don’t have either one of them, work with a financial planner to develop one.