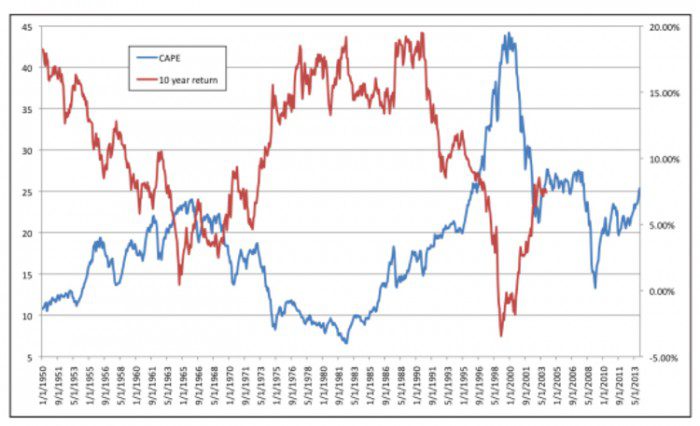

In our recent mailing about the CAPE formula, we discussed how we use this valuation measure in our investment outlook strategy. The graph below (Graph 1) demonstrates that when an asset class is undervalued there are high correlations with stronger future returns over the next 10 years.

Emerging market valuations are now at a 5 year low versus other asset classes. The recent weakness in emerging markets holdings have improved valuations in this area making future return potential even greater over the next 7-10 years.

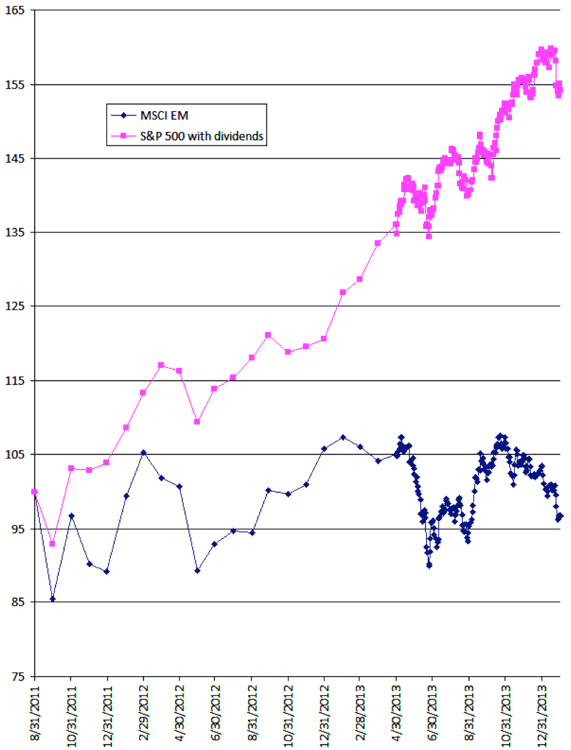

As you can see in the chart to the left (Graph 2), since the last significant market drop we had around the debt ceiling debate in 2011, emerging market stocks have performed very poorly compared to US holdings.

It can be very difficult to invest in an area where performance has been disappointing, especially when you hear reports on the news and stories from friends about double digit returns elsewhere. However, you typically only get the opportunity to buy stocks at low prices because they are being avoided by most investors.

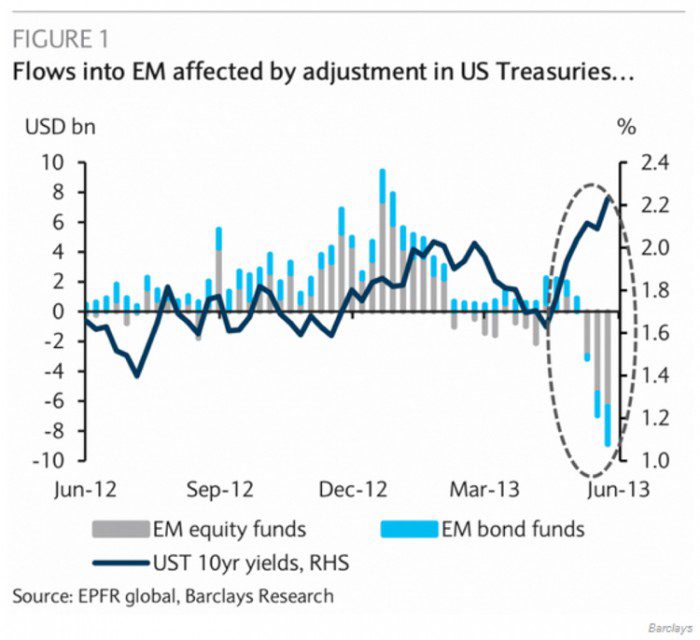

We also track sentiment numbers in our outlook analysis, one of which is the amount of money moving in and out of mutual funds and ETFs. As we noted, so far emerging market performance has been poor in 2014.

In addition, in the first five weeks of 2014, investors pulled more money from emerging market funds and ETFs than they did for the whole year in 2013.

EM stocks have now had 15 straight weeks of outflows, which beats the previous record of 14 weeks in 2002 (see Graph 3).

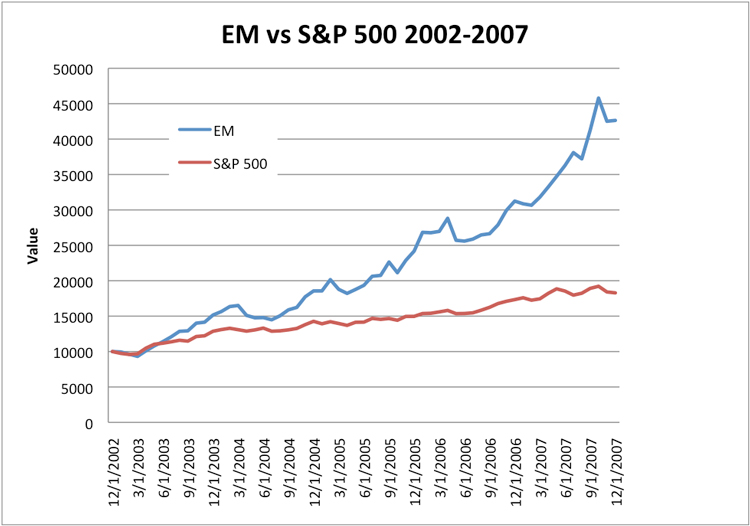

Coincidentally, after 2002, emerging market holdings turned out a huge outperformance against the S&P 500 through 2007 (see Graph 4).

This is not to say this growth will be without volatility as emerging market holdings typically experience a wider range of movement than other asset classes.

It’s also nearly impossible to predict changes over the short-term which is why we focus on longer trends in the market.

We’ll continue to monitor these changes and be on the lookout for our latest “Under the Hood” commentary focusing on one of the funds we are using to implement this strategy.